Are you in good hands?

Published 4:44 pm Monday, November 28, 2011

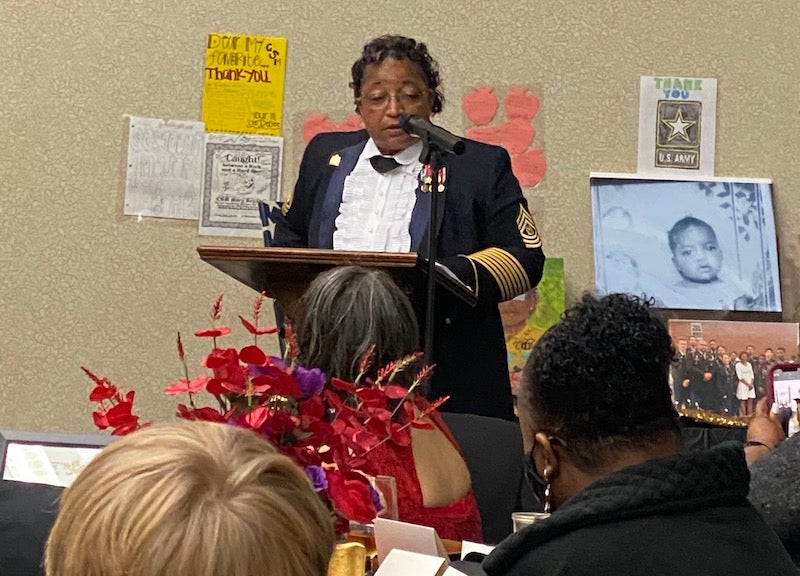

Allstate Insurance Agency owner Connita Griffin Turner, seated, and Customer Account Representative Alyssa Scott work hard to earn their customers’ trust and confidence. (Contributed)

By MOLLIE BROWN / Community Columnist

Are you in good hands?

You’ve seen the commercials. Storms toppling trees on houses and power lines, flood or hail damage to vehicles and fires destroying homes. You hope you never have to deal with a catastrophe, but reality is you probably will.

Many families dealt with storm damage last spring, mine included. A tree fell on our house, and I immediately contacted my Allstate agent, Connita Griffin Turner, to file a claim.

To be honest, I dreaded the process thinking of haggling with an adjuster, but it was just the opposite. I was impressed with the professionalism and very satisfied with the reimbursement.

Turner had vast marketing and sales management experience prior to opening the Griffin Turner Agency. After receiving a degree in commerce and business administration from the University of Alabama, she worked for the Centers for Disease Control in Atlanta. After two years, she transferred to the U.S. Securities and Exchange Commission. It was here Turner learned to scrutinize paperwork and acquired investing experience.

“Everything I’ve done leading up to owning my agency has prepared me for what I do today,” Turner said. “Attention to detail, interpreting legal connotations and documenting are very important in the insurance business. As a fiduciary for my clients I personally read and interpret everything, not just check it out.”

Turner tenured with the federal government, but moved back to Birmingham because of her engagement to husband Melvin. She was hired by AT&T where she worked in commercial sales and international marketing. Ten years later, she was employed with Charter Media, managing 13 local origination advertising channels. Turner was happy with her job, but someone suggested she check out the insurance industry because of her sales and marketing background.

“My kickboxing instructor’s wife, a State Farm agent, suggested I check out the insurance industry. I didn’t know anything about insurance and it sounded sort of blah, but took her up on it as a challenge. I began the application process, was approved and developed a business plan. I chose to locate my business in Calera.”

Though approved for Calera, based on demographics State Farm felt another location was better. Believing God was leading her to Calera, Turner began the process again with Allstate, her personal insurance carrier, and opened for business in August 2006.

If you need home, auto, motorcycle, boat, life or business insurance or help with financial services, contact Turner at 668-6351 or Cgturner@allstate.com. You’ll be in good hands with the Griffin Turner Agency.

Mollie Brown can be reached at dmjhb1@bellsouth.net.